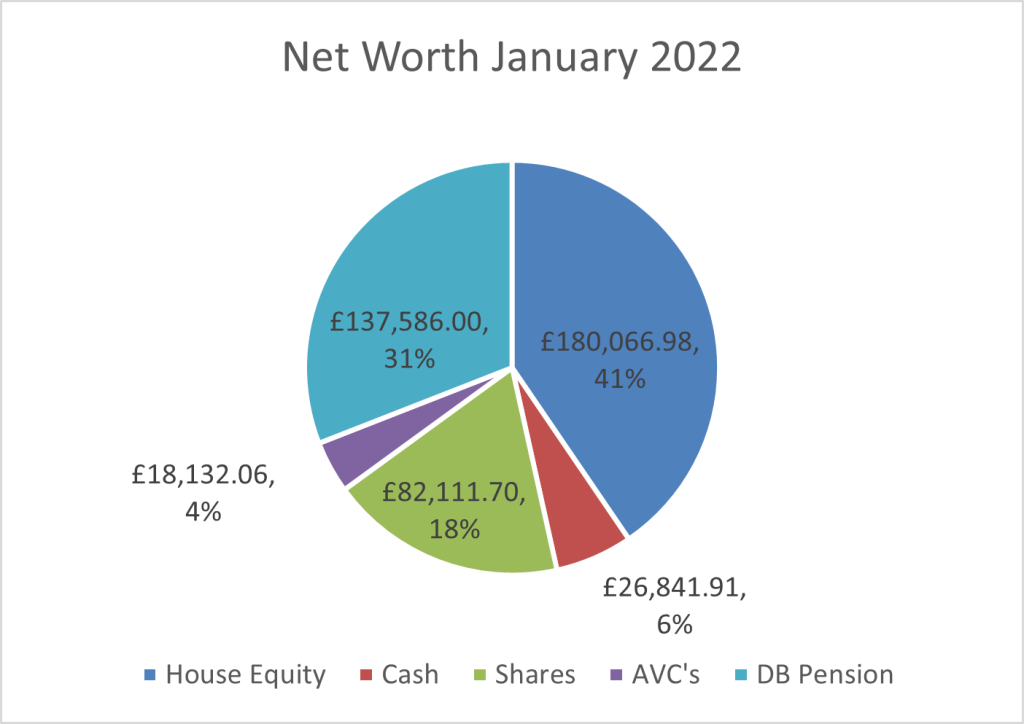

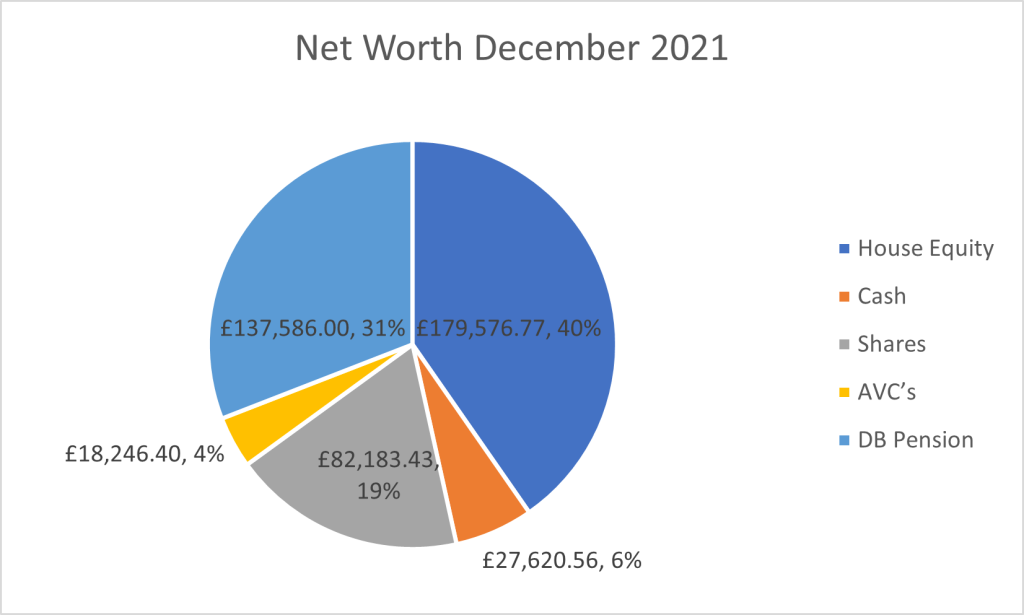

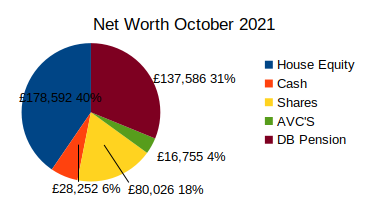

It’s been a while. I’m not really sure why. I guess I got busy with life and could never quite be bothered to get round to writing a blog post. That’s not to say that I’ve not been thinking about FIRE, as I most definitely have. I’ve also been doing my net worth each month. I’ve got past the point where I sit and stare at my spreadsheets for hours on end. Just as well really. I’m not sure that was entirely healthy! So I see that I haven’t done a monthly review since July 2022. Let’s rectify that now. I’ll just leave July 22 figures in brackets below so we can see how far (or not!) I’ve come.

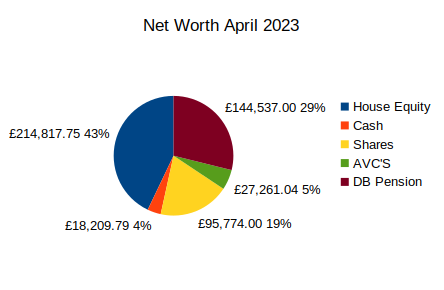

I’ve got my Defined Benefits Pension in there based on twenty years worth of money if I start drawing it at 60. I track how I’m doing with my mortgage balance compared to my AVC balance. The reason for this is th

Paragraph

Start with the basic building block of all narrative.

Learn more(opens in a new tab)

Colour

at I made a decision to mostly stop overpaying my mortgage. Instead I use that extra money to put more into my AVC fund. So hopefully I’ll start to see my AVC fund increase in value and more slowly my mortgage balance come down until they meet at some point and I have enough in my AVC fund to clear my mortgage when I retire. That’s the plan anyway.

Debts

Mortgage £82,182.25 (£86,135.23)

Assets

Cash £18,209.79 (£23,116.56)

Defined Benefits £144,537 (£137,586)

AVC’s £27,261.04 (£20.676.23)

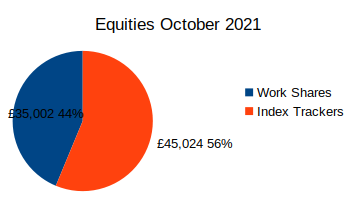

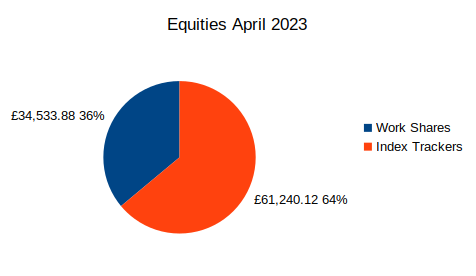

Shares £95,774.00 (£82,838.98)

House £297,000(£278,089)

Total £582,781.83 (£542,306.77)

Net Worth including house equity

£575,830.83– £82,182.25 = £500,599.58( £456,171.54)

AVC Fund vs Mortgage Balance

£ 27,261.04– £ 82,182.25= -£54,921.21 (-£65,459)

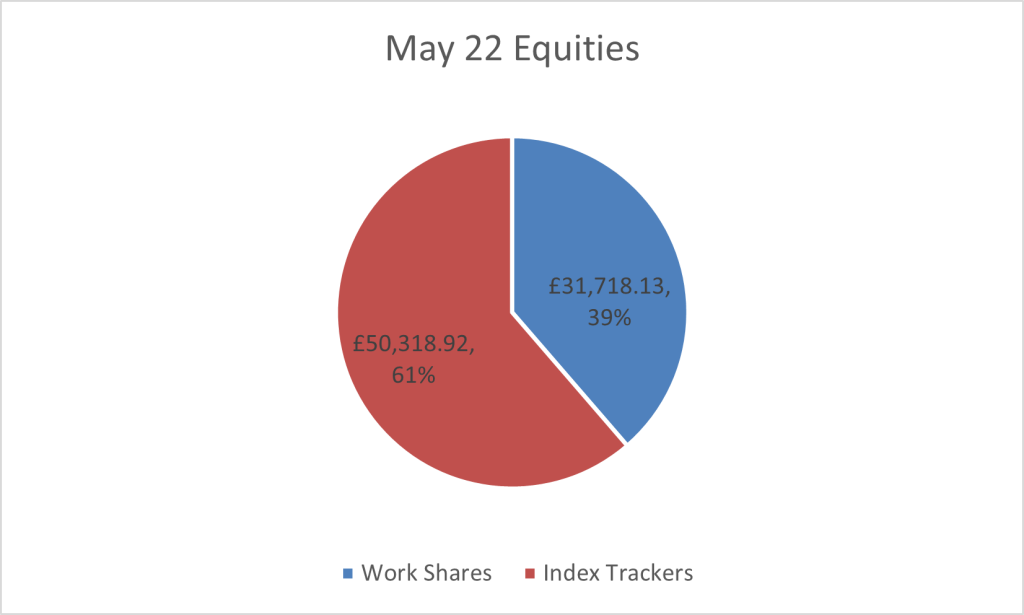

It really is slow going. The figures are definitely going in the right direction, but I don’t think I’ll be stopping work any time soon. I’m doing what I can though. I’m continuing to put as much into my AVC fund as I can afford to. This is the first month that I’ve had to stop paying into my Vanguard tracker fund. I don’t have enough spare cash now to pay into both my AVC fund and my Vanguard account. So moving forward I’m just going to be dependent on what I’ve already paid in growing. I’ll still be putting £30 a month into my work shares as they match my £30 for £45 free shares each month. That’s too good to pass up.

My cash is really as low as I’m comfortable with it being. I have £14k in savings and the rest floating about in various current accounts. I’ve simplified my budgeting massively. Instead of having set amounts for different budgets each month I now have a spreadsheet with my disposable income at the top and every time I spend anything it comes off my available balance for the month. I do squirrel money away as and when I can towards known future expenses – and yes car I am talking about you. A £1500 garage bill nearly finished me off this month, but luckily I had put some to one side for it. The perils of a 12 year old car. My plan is still just to run it into the ground.

I’d gone through a real post lockdown phase of saying yes to absolutely everything. Whilst that’s incredibly good for your social life it does somewhat kill your bank balance. Saying that I’m trying to balance reaching retirement before I’m too old to enjoy it with having a good time now.

Away from the finances things are going pretty well. The ultra that I talked about last year as being too far away to worry about is now rather disturbingly next week. 47 miles up and down hills and around Lake Windemere. It should be fantastic. I’ve done the training. It’s nearly killed me, but it’s done. I’m tapering now, which perhaps explains how I have time to sit down and write a blog post! I go from total optimism to thinking I’m completely crazy to contemplate doing such a thing. I’m going to take not getting airlifted to hospital and finishing the race as a success. We’ll see!

In other news I’ve got myself a boyfriend/partner/partner in crime, whatever you want to call him. We’re 5 months in and it’s going very well. I’ve clearly got to a certain age, as I met him at a funeral! In my defence we knew each other years ago and just hadn’t seen each other for a very long time. So I wasn’t cruising a funeral to pick up random men! It’s a bit surreal but very nice to be in a relationship after all this time. He even used to run and I’ve encouraged him back down that road with lots of trips to parkruns.

Both of the kids are now off at uni, although I think it’s likely the youngest will be back living at home next academic year due to a lack of affordable housing. It’s great to see them both making their way in the world. They’ve definitely inherited the frugal gene that’s for sure. I keep banging on at them about getting money invested as soon as they start working so compounding can do its thing and they can retire when they’re young if they want to.

All in all things are ticking along very nicely. My figures continue to go in the right direction, albeit with certain dips thanks to the turbulent markets. My cunning plan to get my AVC fund to a point where I will be able to pay off my mortgage seems to be working. I’ll be fine to retire at 60, and maybe with a prevailing wind even a year or so earlier. Fingers crossed!