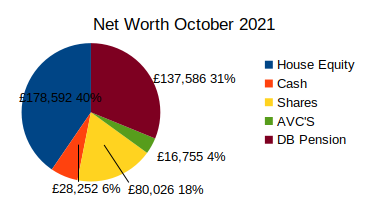

As usual I’ve got last month’s figures in brackets for comparison. I’ve got my Defined Benefits Pension in there based on twenty years worth of money if I start drawing it at 60. I track how I’m doing with my mortgage balance compared to my AVC balance. The reason for this is that I made a decision to mostly stop overpaying my mortgage. Instead I use that extra money to put more into my AVC fund. So hopefully I’ll start to see my AVC fund increase in value and more slowly my mortgage balance come down until they meet at some point and I have enough in my AVC fund to clear my mortgage when I retire. That’s the plan anyway.

Debts

Mortgage £90,408.16 (£90,900.44)

Assets

Cash £28,252.00 (£28,202.74)

Defined Benefits £137,586 (£137,586)

AVC’s £16,754.95 (£15,346.81)

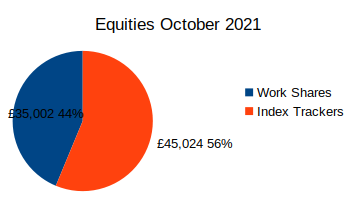

Shares £80,026.26 (£73,460.94)

House £269,000 (£269,000)

Total £531,619.21 (£523,596.49)

Net Worth including house equity

£531,619.21 – £90,408.16 = £441,211.05 (£432,696.05)

AVC Fund vs Mortgage Balance

£16,754.95 – £90,408.16 = -£73,653.21 (-£75,553.63)

That’s a very pleasing set of figures. The markets very kindly did a big jump up just as I was working my monthly figures out. I’m very happy with that increase in the value of my shares. Of course since then the work share price has dropped again a bit, so next month’s figures might not be quite so impressive. For now though I’m happy with the increase. Nice to see the chunk of money that I put in from dividends and the sale of some of the work shares doing so well.

I always like to have arbitrary targets to aim for, just to break up the monotony of striving for FIRE. There’s a few coming up that I have in my sights. My mortgage will duck under £90k next month. Still far too high for me to feel complacent about, but I can see my plan working of paying into my AVC fund rather than overpaying my mortgage. Saying that, all this talk of increasing interest rates is making me somewhat jittery, but in the grand scheme of things rates are not likely to change enough for me to adjust my strategy. Investment wise I’ve got £45k in my Vanguard account, and it will be nice to see that hit £50k. And when I combine my shares and AVC fund I’m just shy of £97k. It will be lovely to hit £100k as psychologically that is such a big barrier. A few things there for me to reach in the hopefully not too distant future.

I didn’t set myself any goals for October and I’m going to continue in that vein for November too. I’ve got an ongoing battle with my mental health, which is taking all my focus for now. I made some really good progress this month, returning to work on a phased return. I’m back to full time hours from next week and and back on the phones then too speaking to customers again. It’s been a bit of a bumpy ride getting back to work, but it’s an important step in me learning to live with this anxiety for the time being until I hopefully get back on a bit more of an even keel.

The main thing want to focus on is my health again. The positive that I can take from the difficulties I’ve been having is that I am really drilling down on what is important for my health. I’ve talked a fair bit over the last few years about how important I feel sleep is for our health. That belief hasn’t always translated into me actually going to bed early, but I certainly have recognised how much better I feel when I get more sleep. Getting enough sleep is no longer an optional extra for me. A combination of my feelings and the medication I’m taking are making me absolutely exhausted. It gets to 8.00 and I’m thinking “how soon can I go to bed?” I’m sure I won’t always feel like this, but for now sleep is absolutely crucial for me. I use a sleep tracker and during October there were only four nights where I didn’t get at least eight hours sleep. I’m still exhausted all the time, but at least I’m giving my body the best possible chance to deal with everything that is going on.

Similarly my eating is going really well. Again this is something I have repeatedly set myself goals around. My weight has fluctuated my entire life, and whilst most people would say I was slim and not notice when I put weight on, for me it’s been a big issue. For now I am not beating myself up about what I eat, but I am focussing on eating plenty of fruit and veg and avoiding sweet food. Without really trying I have lost a reasonable amount of weight. I’m only a couple of pounds away from the lowest my weight ever goes. I feel trim and most importantly it’s not feeling like a struggle. I didn’t consciously set out to lose weight. It sounds ridiculous, but I just started buying more nice healthy food and stopped buying myself sweet treats. We’ll see if I can keep this up once I’m back to dealing with customers all day long and working full time hours. I’m quietly confident. It feels like something has changed. I’m eating for my health rather than for my weight. Of course it could just be stress and the medications causing me to lose weight, but hopefully not.

My running on the other hand is not going so great. I’m still going out, but only for 3 or 4 miles at a time. Since I went on Prozac I don’t seem to be able to run to save my life. My legs feel sluggish and the anxiety is causing me difficulties in regulating my breathing. It seems unbelievable that I managed to pull the Great North Run out of the bag just back in September. I’m not going to worry too much about this. I don’t have any races until May. I’m treating running as a form of therapy just now. My fabulous running friends (well, you know they are actual friends but we met through running and it’s our favourite thing to do together) are making sure that I get out so that I get some exercise and chat about how I’m feeling. They really are outstanding.

I’ve got a couple of trips out this month. I’m through to Edinburgh with one of the kids for a symphony concert and I also have some comedy to go to with a night out to see Chris Ramsey with one of my friends. It’s nice to have a couple of things to look forward to, and I might even get my favourite boots re-heeled, and possibly even my first haircut in over a year. I’m hoping that’s a sign that I’m starting to feel a bit better and ready to start participating in the world again. Here’s hoping!