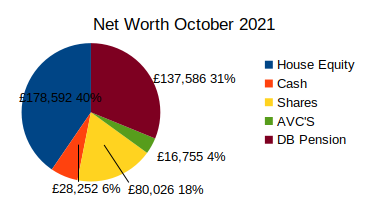

As usual I’ve got last month’s figures in brackets for comparison. I’ve got my Defined Benefits Pension in there based on twenty years worth of money if I start drawing it at 60. I track how I’m doing with my mortgage balance compared to my AVC balance. The reason for this is that I made a decision to mostly stop overpaying my mortgage. Instead I use that extra money to put more into my AVC fund. So hopefully I’ll start to see my AVC fund increase in value and more slowly my mortgage balance come down until they meet at some point and I have enough in my AVC fund to clear my mortgage when I retire. That’s the plan anyway.

Debts

Mortgage £88,933.02 (£89,423.23)

Assets

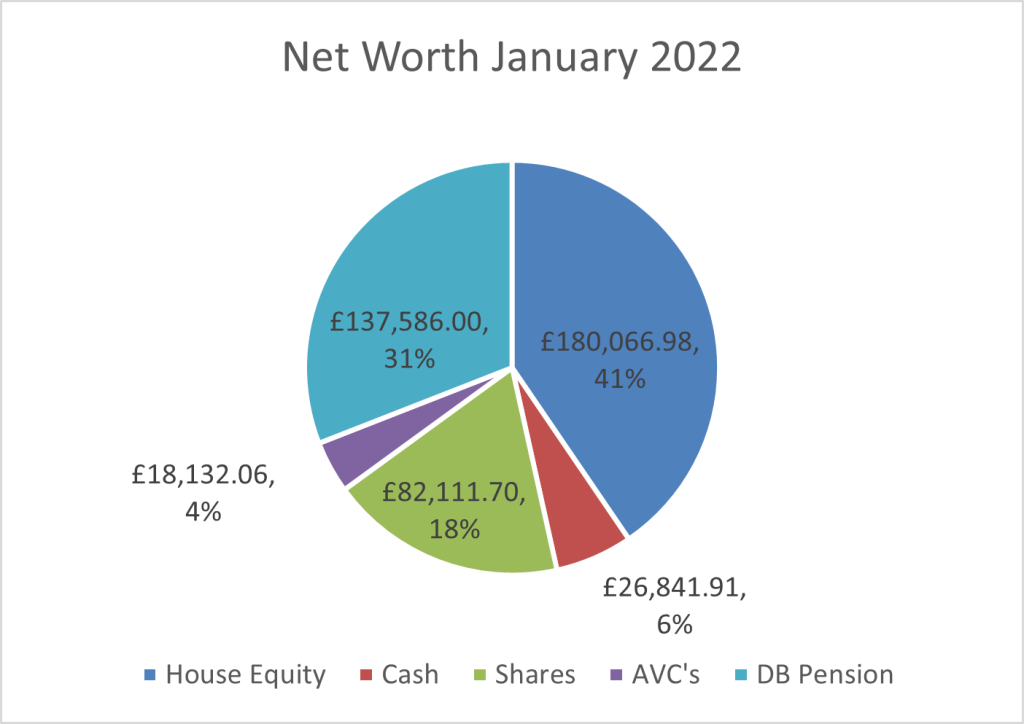

Cash £26,841.91 (£27,620.56)

Defined Benefits £137,586 (£137,586)

AVC’s £18,132.06 (£18,246.40)

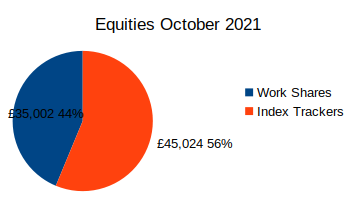

Shares £82,111.70 (£82,183.43)

House £269,000 (£269,000)

Total £533,671.67 (£534,636.39)

Net Worth including house equity

£533,671.67 – £88.933.02 = £444,738.65 (£445,213.16)

AVC Fund vs Mortgage Balance

£18,132.06 – £88,933.02 = -£70,800.96 (-£71,176.83)

Cash is down a bit yet again. Life seems to be very expensive at the minute. Car repairs, insurances, trips away, lots of petrol for yet another big long trip to Cambridge to drop off uni boy. You know what though? Life is for living. The car repairs I could do without, but the trip to Cambridge was brilliant and the more things like that I can do the better. I’m not frittering money away on nonsense. I’m spending money on things that I need or experiences that I want. I’m not breaking the bank and I still have plenty in savings, so I’m not going to worry too much. Not very FIRE of me, but what the hell!

Considering the state of the markets just now I’m fairly happy with my investment figures. Down very slightly despite me having paid another month’s worth of money in, but it could be a lot worse. Given the recent Bank of England base rate announcements I’m slightly jittery about the amount of mortgage debt I have. I’m sticking with my decision to barely overpay my mortgage and stick the money into my AVC fund instead. Unless interest rates get ridiculous I’m happy this is the right route for me. Time will tell I guess.

January has gone fairly well. Mum and dad came up to stay for a week which was lovely but quite full on. I was working, but we managed to get plenty of walks and talks in. I’ve lived on my own (well with the kids) for so long I find it quite exhausting having other people in the house. It’s made me realise how much I value my own company and time to myself. Saying that we did have a great time and it was lovely to spend time with them.

I’m well in the swing of half and full marathon training now. In terms of the number of weeks I need to complete on my marathon training plan I am now a quarter of the way through. Of course the miles really ramp up the further you get through the plan. In a moment of rash confidence I have signed up for an ultra marathon in the summer. An ultra is anything longer than a marathon, in this case 55km or 34 miles. Having said last year that I thought I should stop doing the longer races as I kept getting injured, I now have 2 halves, 1 full and 1 ultra marathon race this year.

Doing a full marathon and an ultra is on my 60 for 60 list, so it’s not completely come from nowhere. My thinking was if I was training for a marathon then I might as well combine that with training for an ultra. Having signed up I’m not quite sure how compatible the training is going to be. In an ultra the idea is that you cover the miles as efficiently as possible. So you walk the hills and run the flats and downhills. You also eat as you go, so I need to practice fuelling on the go. How bad can it be??? I go from complete and utter exhilaration at the thought to total terror at getting lost in the woods and never being seen again.

I didn’t set specific goals for January, but this is what I wanted to work on.

‘A trip to Cambridge, start my marathon training plan and get my eating sorted and my weight back to where it usually is. I also want to finish unit 6 of the Spanish Duolingo course.’

I had a great trip to Cambridge and I am well in the swing of my marathon training. The eating is a little bit all over the place. I’m doing a bit better now, but it’s not been great. My weight has fluctuated quite a bit. I started HRT this month, so I’m going to go with that’s the reason. I’m not quite sure it is, but it’s possible I guess. Either way we’re mid February now and I’m less than half a stone from my ideal weight. I’m trying not to focus on that too much. I want to eat for my health and not for my weight. Saying that I really don’t want to be dragging excess weight around with me when I’m running long distances. I’m working hard on my Duolingo Spanish. I don’t know what I was thinking saying I could finish unit 6. Getting unit 6 and 7 is realistic by the end of the year, so unit 6 is going to take me a while. I’m enjoying it though and still feel that I’m making some steady progress.

For February I don’t think it’s going to be a massive surprise that running features quite a lot. Here’s what I want to work on

- Continue to follow my marathon training plan

- Find an ultra training plan and figure out how to combine this with the marathon plan

- Walk at least once a week

- Do 2 lessons a day on Duolingo Spanish

- Watch at least 4 episodes a week of Betty en NY in Spanish.

- Finish setting up spreadsheets with alternative retirement dates and how much I need to have in investments (Finally a FIRE goal, yay!)

- Go to the cinema and watch The Godfather (It’s always good to have a fun goal, and considering how much I love this film I have to take advantage of it being on the big screen for an anniversary showing)

That’s plenty for me to get cracking with in February. Work is busy with lots of new things for me to learn there. Managing work, getting my runs in, not eating too much rubbish and getting plenty of sleep . If I manage all of that then I’ll be happy.